True value shows in the ebb tide in VC industry

Apr 7 2024

The lowest tide shows real value

In a high-demand situation, it can be very difficult to distinguish which products have real value. However, just as the tide recedes after high water, revealing what lies beneath, a market correction can make it easier to identify companies with true value for investment. Similarly, when the tide is high, all ships seem to float effortlessly. But as the tide recedes, some ships that appeared seaworthy run aground, revealing their true condition. The shocking truth is that the ships were sailing without a margin of safety.

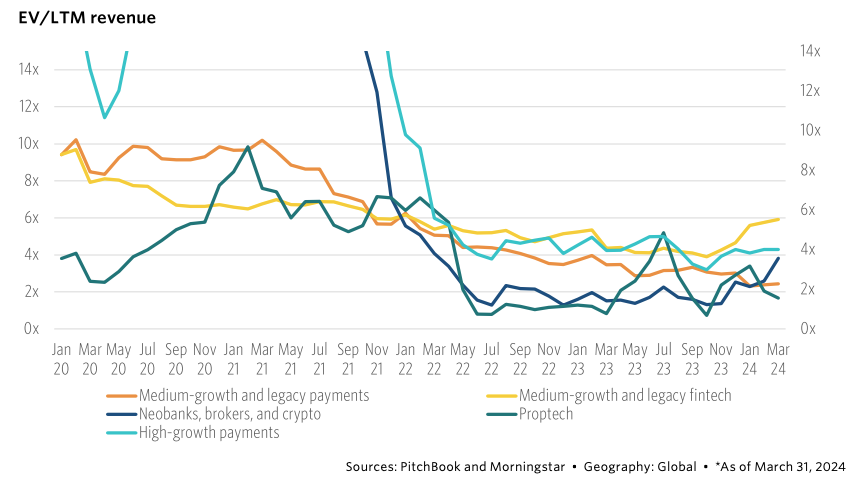

Historical EV/LTM revenue

The attached chart is historical enterprise value divided by latest twelve month revenue.Since the peak in revenue multiples, there has been a cohort of companies that have seen their valuations discounted by more than 80% despite continuing revenue growth. This suggests that the traditional view of revenue multiples being independent of gross margin may no longer hold true. Over the past decade, there have been instances where revenue multiples were likely overestimated, particularly for companies with limited gross margin and EBITDA.

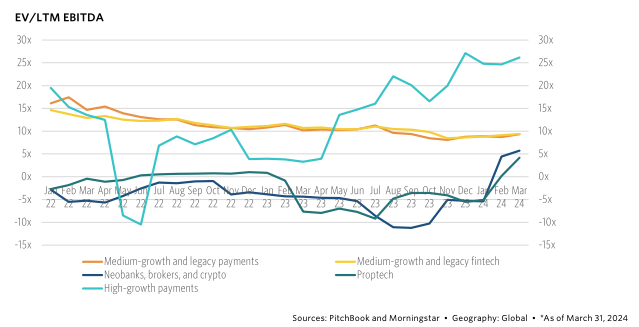

Historical EV/LTM EBITDA

For healthy hyper-growth, a high gross margin (ideally above 70%) is crucial. Products with gross margins exceeding 70% allow for significant reinvestment in growth when general and administrative (G&A) costs are kept at around 30% of gross margin. This translates to a high pure-EBITDA margin (contribution margin in mass production is around 49%), which facilitates easy scaling through the reinvestment of operating cash flow.

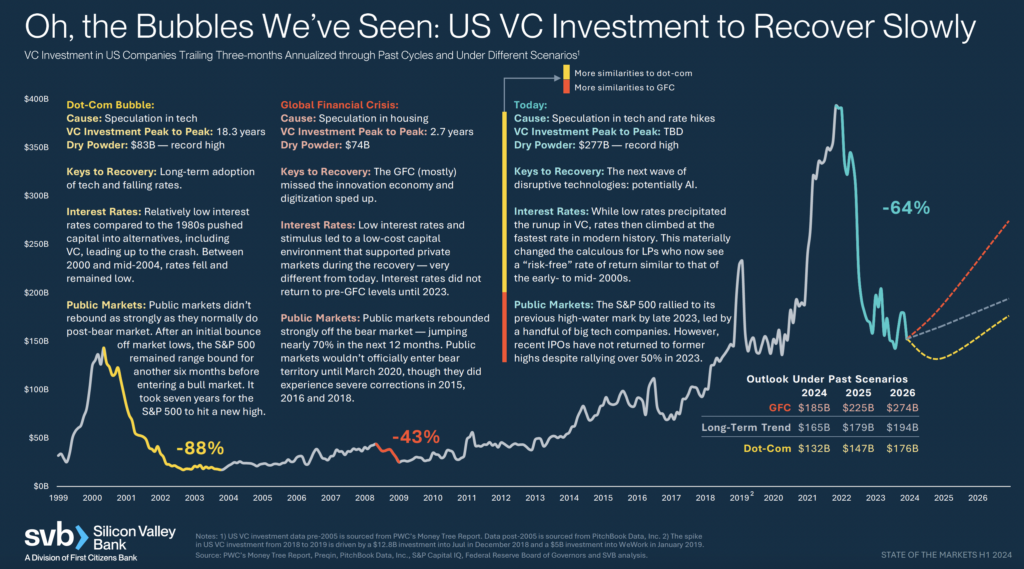

Predicted time to recovery

Historically, financial crashes have typically seen a recovery starting after 3 years according to SVB data, with a full recovery following within 6 years. According to the history, the VC industry’s full recovery from the current downturn might take longer, potentially reaching pre-2022 levels only after 6 years.

Do not forget ebb tide

Nevertheless, it’s important to remember that EBITDA and operating cash flow are the most reliable indicators for a company’s ability to weather economic downturns.